Despite a slide in the price of gold of almost epic proportions, work on the Long Canyon Mine project 30 miles west of Wendover will continue unabated, said Newmont Mining officials.

“Of course we have had to adjust and reevaluate,” said Newmont Mining executive Mary Korpi in a Monday interview. “Some projects have been put on the back burner but the Long Canyon project is not one of them.”

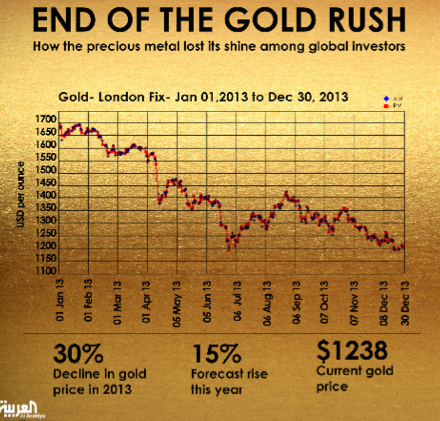

From January 2013 to December the price of gold has fallen 30 percent from $1,700 to $1,200.

The steady erosion in the price of the precious metal resulted in some layoffs in Elko county during the spring, summer and fall.

The steady erosion in the price of the precious metal resulted in some layoffs in Elko county during the spring, summer and fall.

But while the slide has been dramatic it has been no where near as devastating as the crash in the late 1990’s when the price of gold actually fell under $300 an ounce below the cost for most Nevada mines to extract the metal.

At the turn of the millennium hundreds if not thousands of jobs were lost and rural Nevada was plunged into deep recession because of the gold death spiral. Experts were predicting that gold would never again seen the $700 an ounce mark of the late 1970’s, and the odds were long against the precious metal would reach again the $450 sweet spot that made gold ming profitable for Nevada mines.

The experts were wrong.

The price began to recover in 2002 and by 2006 it had in fact reached the $700 an ounce mark. It broke the $1,000 an ounce mark in 2008 and in 2011 flirted with the $2,000 an ounce mark.

The price began to recover in 2002 and by 2006 it had in fact reached the $700 an ounce mark. It broke the $1,000 an ounce mark in 2008 and in 2011 flirted with the $2,000 an ounce mark.

And while the price of gold has fallen about $800 an ounce since then, it is still about $800 north of the sweet spot.

This is especially true of the Long Canyon site where much of the ore can be mined profitably at around $300 an ounce ago to some estimates.

Newmont commitment to the project will probably not dissipate no matter what this year since it is still in the permitting/exploration phase and with the earliest construction start date estimated for mid 2015 any fluctuation in the price of gold this year is essentially irrelevant for the Long Canyon project.

That is not to say that could change. The price of gold could fall dramatically or on the other hand it could just as easily rise.

That is not to say that could change. The price of gold could fall dramatically or on the other hand it could just as easily rise.

“Unlike other industries gold mining really has no impact on the price of gold,” Korpi added.

Everything else does. From agricultural production to industrial output the gold is perhaps the one commodity that is influenced by the great and the small except when it is not.

When the metal fell in the late 1990’s it was considered a permanent market correction a result of the peace dividend and the fall of the communist system.

When the metal fell in the late 1990’s it was considered a permanent market correction a result of the peace dividend and the fall of the communist system.

Instead of dealing in the precious metal trade between east and west would be based on dollars or credit cards rather than bars of gold.

That thinking was true until suddenly it wasn’t anymore. The price began to increase coincidentally with the wars in Afghanistan and Iraq and also with surge of the Chinese and Indian economies.

Gold traditionally rise with political and economic uncertainties however with now almost the entire world connected instantly it is incredibly difficult to predict just what event or events will either spur or shrink demand.

For the sake of moral the Saudi gold market is predicting that gold will recoup about half of its 2013 loss in 2014.

The Saudi gold exchange is one of the largest in the world and does have a major influence on the price of the precious metal.

The Saudi gold exchange is one of the largest in the world and does have a major influence on the price of the precious metal.

On the other hand last year it was predicting a return to the $2000 and ounce mark.